How to find the right backpacking travel insurance

Looking for and getting the right travel insurance is one of the biggest headaches for any traveler but as essential for your adventure as your backpack.

From backpacking in Sudan, Iraq and pretty much everywhere in the Middle East to trekking over 5,000m in the mountains of Pakistan, Kyrgyzstan and Tajikistan and also traveling across Southeast Asia and Africa, for the last few years, I have experienced quite a few different adventures across a large number of different destinations.

Therefore, after gathering some hard-backpacking experience and having tried many different travel insurance companies, I realized about the following:

Finding the right travel insurance is not about finding the cheapest or the one with the highest coverage, but the one which will fully cover your needs as a traveler and the purpose of your trip

That being said, if you are reading this article it is because you are an independent traveler who mostly travels with a backpack, which means that you are looking for a backpacking travel insurance.

Well, in this article I will help you find the right travel insurance for backpackers according to your kind of trip and the type of traveler you are.

In this tutorial you will find:

Overview – Best travel insurance

What you need to look for when choosing backpacking insurance

Best travel insurance for backpackers

- The premium backpacking insurance

- Travel insurance for European backpackers

- Budget backpacking insurance

- Travel insurance for high-risk countries

Total transparency! – If you like my website and found this post useful, remember that, if you buy any service through one of my links, I will get a small commission at no extra cost to you. These earnings help me keep Against the Compass going! Thanks 🙂

Best backpacker insurance comparison – QUICK OVERVIEW

[elementor-template id=”24104″]

What do you need to look for when you purchase travel insurance for backpacking?

What do backpackers have in common?

- They may do adventurous activities, such as trekking, horse riding, etc.

- They move around on cheap, local transportation, so the risk of an accident is higher

- The likelihood of being robbed is higher, as they stay in budget dorms, go out at night and travel on local transportation

- They usually travel to several countries in one single trip

- We tend to travel with plenty of travel gear (drones, cameras, laptops, etc.)

Proper travel insurance for backpacking should cover the above criteria, so when looking for the right one, you need to make sure about the following:

It offers high medical coverage

If you are planning to do some adventurous activities (so the risk of an accident is higher), or you are traveling to a country where the health care system is very expensive (like the USA for example), you should know that hospitalizations costs could rise to several and several thousand USD.

There are many cheap backpacker insurances that will offer you a cheap quote but, if you read the small print, you will see that they will just give you 10,000 or 20,000USD of medical coverage, which can be very little depending on your type of trip.

It covers adventure activities

If you are planning to do some trekking or any other related activity, you need to make sure that your policy covers that.

For example, if you are traveling to Nepal, you need to make sure that your policy covers for trekking up to 4,000-5,000 meters at least and you should know that not all insurance providers will cover it.

Most backpacking insurance will have a specific plan for this type of adventure activities.

High coverage for medical evacuation

Medical evacuation is the process of moving you from the place you had an accident to the hospital and, eventually, to your house.

If you break your leg while trekking in Kyrgyzstan, for example, the cost of being rescued by a helicopter, sent to a hospital and put on a plane back home can rise to a couple hundred thousand USD.

Too cheap travel insurance for backpackers will barely cover you for that.

It has worldwide coverage

Many backpackers will travel to several countries in one single trip, so when you buy the insurance, you want a provider that allows you to select a couple of countries or a worldwide option.

On the other hand, when you choose the option ”WORLD” you should know that some insurance providers don’t include sanctioned countries such as Iran, Sudan or Iraq – countries widely covered in this blog – so you need to make sure that your insurance covers them.

You can buy it while you are on the road

Very important. Some companies may not cover you if you have already started your trip.

For long-term backpackers, this option should be a must.

It covers for theft and robbery

Seriously, how many backpackers have you ever heard of who had things stolen?

Depending on where you travel to, I honestly think that getting robbed is the most likely unfortunate event that can happen to you.

Moreover, many backpackers have their backpacks filled with many electronic gadgets, so depending on their value, you want to make sure they are covered.

Fight cancellations, baggage delay, and loss

This is also very likely to happen.

One day, they canceled my flight from Berlin to Tehran and, on another occasion, when I flew from Barcelona to Tbilisi, my baggage remained lost for almost 4 weeks.

Of course, you will get the airline compensation benefit but, if you have good travel insurance, you may get paid twice.

And, very important, make sure it is easy to claim

All the companies I have listed are very professional, which means that, when you need to make a claim, they have a fast response.

Comparison: The best travel insurance for backpackers

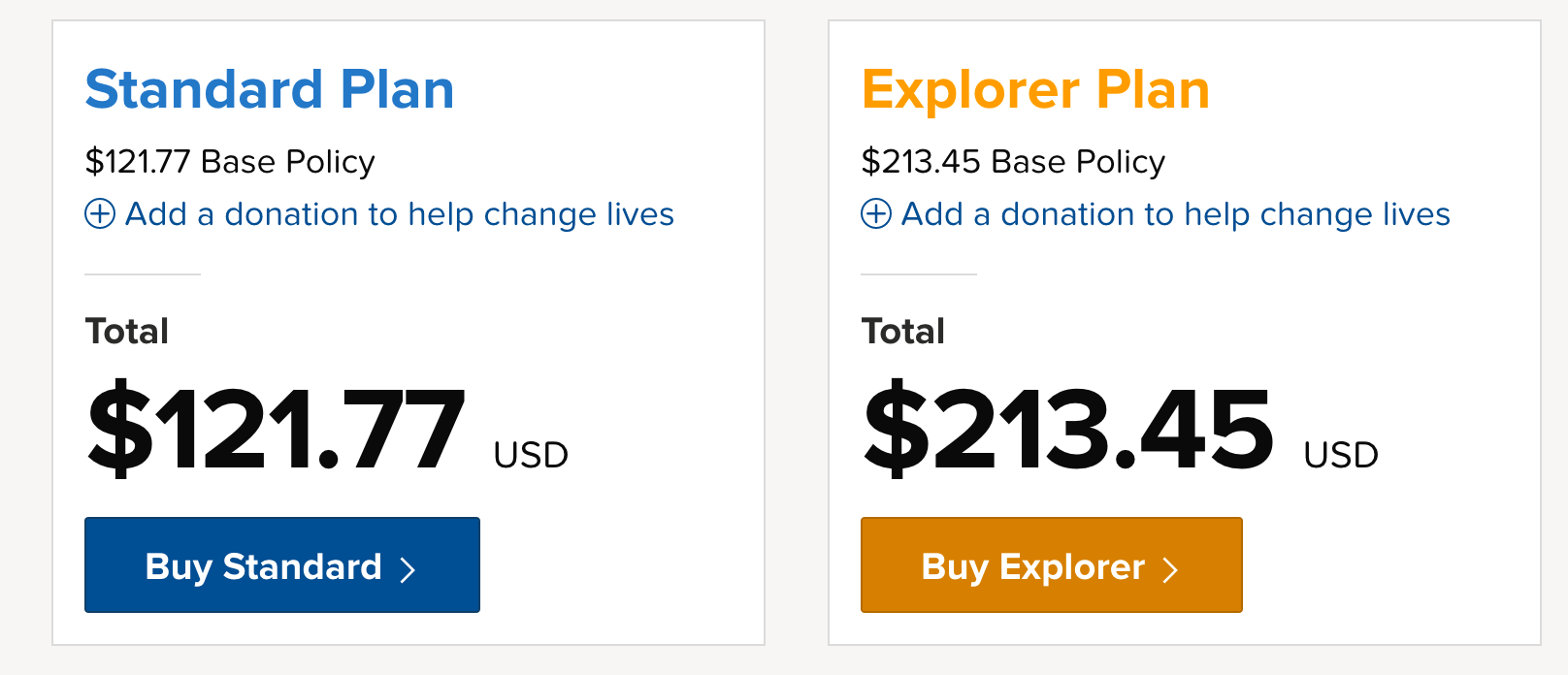

PREMIUM travel insurance for backpacking – World Nomads

World Nomads is one of the most popular travel insurance companies worldwide.

And they are famous for offering the most in-depth coverage on the market, not only medical but they also cover the largest number of adventurous activities.

World Nomads is good for any type of trip, whether you travel to Ukraine to visit cities or go to Nepal to trek over 6000 meters.

| PROS | CONS |

| Most in-depth coverage when it comes to medical expenses, adventurous activities, theft, etc (their most premium plan has unlimited medical coverage) |

You get what you pay for, so World Nomads is the most expensive backpacking insurance |

| High focus on adventure activities, including trekking over 6000 meters and other high-risk activities |

Doesn’t cover many Against the Compass destinations such as Iran, Sudan, Iraq or Syria |

| Simplicity, just 2 plans: one with wide coverage, and another one with even wider coverage and more adventure activities |

Price assuming you are traveling to Nepal for 1 month: From 121$

CLICK HERE YO GET YOUR FREE QUOTE

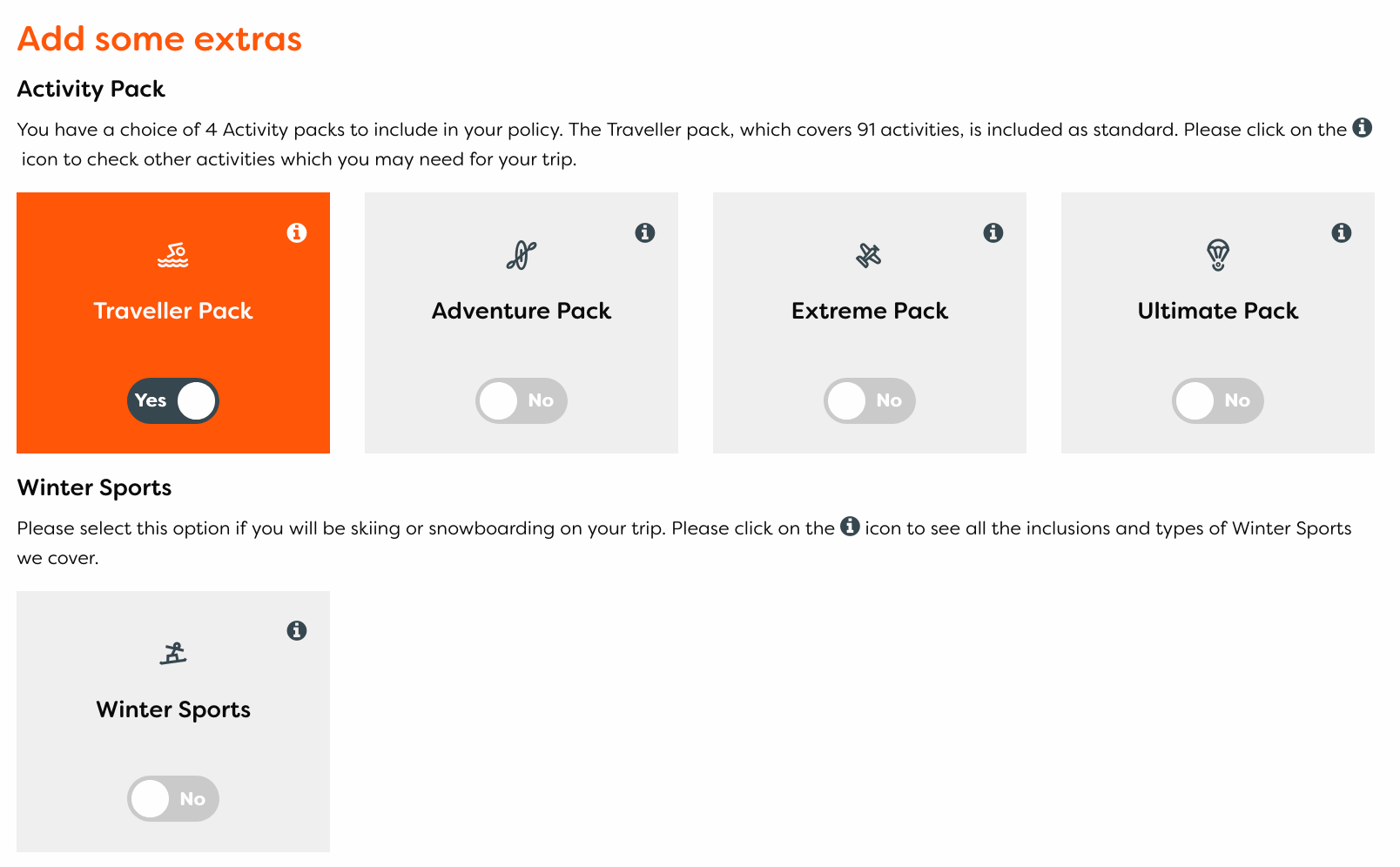

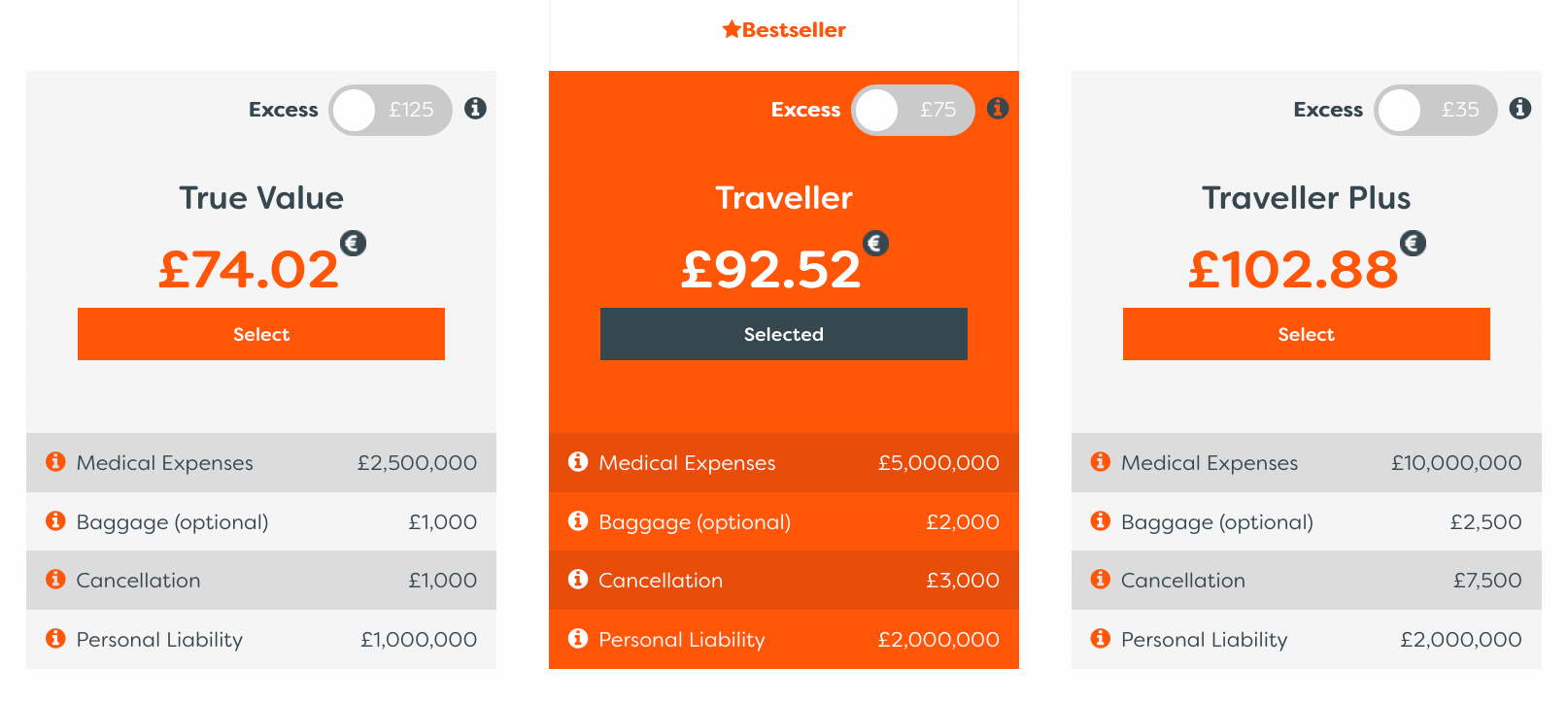

Best backpacking travel insurance for Europeans – True Traveller

True Traveller is the one I am currently using and the ultimate travel insurance for backpackers.

The best things about True Traveller are that, first, they provide coverage for all countries (including Iran, Pakistan, etc.), and second, their coverage is very versatile: it covers an endless number of adventure activities, you can insure your electronics and they even have a special anti-theft plan.

Also, their budget plan includes an astronomical amount of medical expenses, as you can see below.

And last, their website is amazingly intuitive compared to others, making their policies much more transparent. For example, once you have calculated your basic quote, you can easily add all needed extras and, by clicking the ”i”, you get to see exactly what activities it covers, while, with other companies, you need to download and read a 30-page PDF in order to figure it out.

| PROS |

CONS |

| Their basic plans have amazing medical coverage at a very good price |

If you add up all extras, it gets expensive |

| You can insure your electronic gadgets |

They only cover Europeans |

| Very intuitive page with the most transparent policies |

|

| Ideal for long trips: Best annual insurance for backpackers |

Price assuming you are traveling to Nepal for 1 month:

From

£74 (84€)

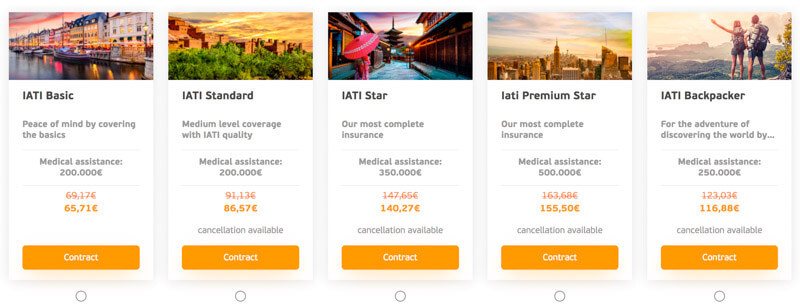

Cheapest travel insurance for backpackers – IATI Insurance

I have used IATI in the past and, in my opinion, it’s the ideal insurance for any type of traveler, from budget backpackers to couples who are going on their honeymoon.

First of all, because it is one of the very few insurance companies that covers travel in any country, including many conflict destinations mentioned in this blog (Iran, Eritrea or Syria); and secondly of all, because it has a plan for any type of trip, from adventurous destinations to sightseeing trips.

Also, if you are traveling with a tight budget, their basic plan is the cheapest available in the market, plus readers of this blog get an exclusive 5% discount.

BUY IT HERE TO GET YOUR DISCOUNT

| PROS | CONS |

| Super versatile, for all types of trip, wallet, and traveler. |

They offer so many plans that sometimes it can be confusing to figure out which plan is best for your trip |

| The cheapest backpacking travel insurance: their basic plan is the cheapest in the market, ideal for low budget backpackers |

Non-Spanish people can’t buy it for trips that last more than 4 months. |

| They have plans that cover adventure travel, including trekking in high altitudes |

Premium plans are expensive |

| Worldwide coverage, including conflict areas |

|

| The readers of this blog get a 5% discount |

Prices, assuming you are traveling to Nepal for 1 month: From 65€

CLICK HERE TO GET YOUR FREE QUOTE

Best backpacking travel insurance for high-risk areas – BattleFace

Lebanon, Pakistan, and Somalia are destinations widely covered in this blog and, even though some insurance companies do cover them, their coverage is limited to just medical emergencies, excluding any act of terrorism.

This means that, if you are injured due to a bomb, you had to cancel your trip because of a terrorist attack, or you had to be evacuated due to conflict, your policy won’t cover you.

So, when you travel in this kind of country, you are recommended to buy specialized travel insurance, such as BattleFace, an insurance provider that takes into account any kind of terrorism event, and will give you full assistance in the unlikely case you ever get caught in the middle of one.

Unfortunately, BattleFace is currently only giving coverage to very few nationalities (like the UK and German passport holders) but they will be adding other countries soon. Meanwhile, if you are worried about terrorism, I recommend you get World Nomads, as they have the most transparent policy when it comes to this topic. CLICK HERE TO LEARN MORE

13 comments

Hi Joan

Great review and comparison of the nomad travelers insurances. We have also try to found out suitable ic because we are leaving from Europe to Caucasus and we just found this British company Globelink International. It seems really suitable for us because it’s seems to be cheapest and gives you even 15 months backpacker insurance. Company also seems quite trustworthy and most of the Google reviews are really positive. Price without equipment cover can be as low as 70eur / 3 months trip. If you have really expensive equipment and you want to cover those, price can actually be close to World Nomads. Would it be okay to contact you about Caucasus for some advice?

Best wishes,

Toni @FinnsAway

Hi Toni, thanks for your feedback. I checked Globellink but I am not very convinced with their base policy. Of course, you can get a really cheap quote but it doesn’t cover Emergency Repatriation, theft, etc… If you add up all these benefits one by one, in the end, you will get a non that cheap quote… I think True Traveller is a better budget option but this is just my opinion 🙂 of course. Anyways, sure you can contact me for your Caucasus trip, no problem.

P.S. I removed your affiliate link. That was not very cool man!

That emergency repatriation is actually bit weird because it covers only within EU but they still sell insurances to all world. Have to ask is this really true. If I did understand GlobeLink baggage insurance policy correctly, it covers up to 300£ total + money, passports etc) if you don’t take extra insurance for equipment. In True Traveller you have to pay even for minimum coverage for your stuff + extra for valuable equipment which still cannot be more than 5 years old. For both, there is still up to sum for one equipment + excess (75£ / 50£). So if you don’t take extra insurance for valuables, difference is about 60€ (without excess) for two months trip to Caucasus per person and if you take maximum coverage for you equipment difference is almost 100€./person But it’s just my calculation. Also I didn’t find any limitation of equipment age in GlobeLink policy. Sorry about the link. Stupid me! But now you know there is Affi also for them 🙂

Have a nice adventures! Let’s hope we meet in real life some day

Hi Joan and thanks for well researched post. It seems that IATI requires travelers to start their trip from Spain or to travel through Spain in order to be able to apply for an insurance policy…. Best, Antoine

Hi Antoine, I was doubting about what you said, as I bought the insurance while being on the road and never stepped in Spain. However, I have emailed the customer service, asking about this rule, because, perhaps, it applies to non-Spanish people but they told me that no, meaning that you don’t need to be in Spain or go through Spain.

The only difference between Spanish and non-Spanish people is that, for legal reasons, non-Spanish people cannot get a more than 4-month travel insurance. The rest works the same for everyone, regardless to which countries you are traveling to.

May I ask where did you get this kind of information? Thanks,

Hi… thanks for this comparison. Im looking into insurances right now and I was wondering what time period the prices indicated here are for? are these costs per month, per year?

Hello. The price doesn’t really change and the costs depends on the range you select. here I selected 1 month

Has World Nomads changed their Standard policy? When we went to Nepal in 2017 we had to get the Explorer policy as were trekking to Everest base camp as it’s at 5500 metres and the Standard only covered to 4500 metres.

Thanks for the recommendation on the travel insurances.

Unfortunately these insurance doesn’t cater for people in my area.

So, perhaps, I should researches for insurances in my country.

Thanks, love the blog, hope to be able to skim through all the material in a another day.

🙂

Hi Joan. I’m looking at travel insurance atm and considering going with IATI as it sounds like the best on paper. I’m wondering have you ever had to file a claim with them and if so how was the experience? (If any other readers have any experiences with this please share too!!)

p.s. Your blog inspired me to visit Ukraine, Moldova and Georgia – thank you for sharing your travel experiences, and helping me make some amazing ones of my own!

David

Hi David! Once I had an eye infection in Ethiopia, I emailed them and on the same day, their local agent contacted me and sent a taxi to pick me up at my hotel. They took me to hospital, and even paid for my medicines. I believe the experience changes country by country but that was mine in Arba Minch, south Ethiopia

Thanks for the great overview! Do you happen to have any experience with SafetyWing nomad insurance? Seems to offer a decent policy and good prices as well as awesome flexibility because it can be cancelled every 28 days and extended as long as you wish. Also it can be bought while already on the move. Moreover coverage is not depending on any State Department’s Travel warnings or stuff. Cons are relatively low coverage amounts (which still seem decent though) and no coverage for some countries that the U.S. has issues with (like Cuba or Iran). Would be great to hear if there are any valuable experiences with them. Thanks!

Cheers, Phil

MASSIVE LOOPHOLE WARNING – World Nomads

Conditions that are “similar”, but unrelated to, a condition that was subject to a previous claim ARE NOT COVERED. Here is an example, in World Nomads’ own words:

“If you were to develop a new stomach condition not related to the previous stomach issue but a similar condition you would not be covered due to it would be considered pre-existing unless it was due to an injury or something totally unrelated.”

I would be happy to share their emails to me for posting on this site.

This is a shocking and appalling loophole, especially for a policy that is marketed towards long term travellers, who are likely to get separate but “similar conditions” – such as stomach issues, the most common travelers’ ailment. This company is unethical and anyone who promotes it without mentioning this loophole is irresponsible (they likely didn’t know, as this provision is not explicitly stated in the policy). World Nomads will not provide any further details on how they define a “similar condition” (affecting the same part of the body? Having the same symptoms? Being a virus or bacteria?), so if you make a claim after getting sick or injured once, you may not have coverage if you get sick or injured again (you have to file a claim to find out). I have confirmed this loophole multiple times, so I know it wasn’t just one agent giving incorrect information. It seems fraudulent that they have this policy but do not state it in their policy documents (all the policy document says is that you only get one follow up visit per emergency, it says nothing about coverage being based on previous emergency claims).